30+ How much can you lend mortgage

If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan would be 99327 and you would pay 15757691 in interest. Get Started Now With Quicken Loans.

Consulting Retainer Proposal Template Retainer Agreement Proposal Templates Marketing Professional

If you were to take on a 200000 loan for example one.

. 1800 20 30 35. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Your earning potential as a Mortgage Loan Officer can increase as you gain experience and.

Looking For A Mortgage. The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly. The following table shows the calculation methods for figuring out the highest payment you could qualify for based on credit rating.

Fill in the entry fields and click on the View Report button to see a. The 30 rule says you dont want to pay more than 1800 a month for your monthly payment. Call us on 1800 20 30 35.

Find loans for country homes land construction home improvements and more. 1 day agoHeres where we currently stand. This time last week it was 593.

Thirty percent of six grand is 1800 if youre bad at mental math If you. Lenders have a certain threshold they arent willing to cross. The average rate on a 30-year fixed-rate mortgage.

For this reason our calculator uses your. At the time of this writing in late August the average 30-year mortgage rate was 588 percent up from 557 percent a month ago versus 508. APR is the all-in cost of your loan.

Ad Calculate Your Payment with 0 Down. This mortgage calculator will show how much you can afford. For instance if you are approved for a 200000 mortgage an excellent credit rating may help you qualify for a 30-year loan at 525 while a less pristine record may qualify.

Ad Compare Mortgage Options Get Quotes. The APR on a 30-year fixed is 599. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Were not including any expenses in estimating the income you. Common mortgage terms are 30-year or 15-year. The maximum amount you can borrow with an FHA-insured.

Buying My First Home. This ratio says that. Youd pay approximately 113760 in total interest over the life of the loan.

The first step in buying a house is determining your budget. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

392 rows With a 30-year fixed-rate loan your monthly payment is 125808. Get Started Now With Quicken Loans. Ad Apply online for a home or land mortgage loan through Rural 1st.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Its A Match Made In Heaven. Medium Credit the lesser of.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. For instance if you take on a mortgage loan that results in a total debt-to-income ratio of only 30 youre probably in good. One mortgage point will typically cost 1 of your loan amount and lower your interest rate by about 025.

Were Americas 1 Online Lender. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Based on how much you can borrow for your mortgage lets find out what your monthly repayments.

If your interest rate was. Ad Compare Mortgage Options Get Quotes. There are clear rules around how much money you can lend for a mortgage.

How Much Mortgage Can You Afford Based On Your Salary Income And Assets. A mortgage loan term is the maximum length of time you have to repay the loan. At an interest rate of 598 a 30-year fixed mortgage would cost 598.

Find out how much you could borrow. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. You may need to use a specialist lender who could cap the amount of money.

On a 30-year jumbo mortgage the average rate is 592 and the average rate on a 51 ARM is 442. Like other FHA loans these loans come with additional rules on top of the standard reverse mortgage requirements. The average rate on a 30-year fixed-rate mortgage is now 566.

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. So if you can qualify for a 30-year fixed rate mortgage anywhere between 3 to 35 youre getting a solid dealCertain mortgages typically have higher rates like loans for. Its A Match Made In Heaven.

Mortgage rates increased for the second week in a row. Were Americas 1 Online Lender. The 2836 rule is a common rule of thumb for DTI.

Looking For A Mortgage. Longer terms usually have higher rates but lower.

Jerome Daniels Mortgage Loan Officer 1616634 973 986 9231

Jerome Daniels Mortgage Loan Officer 1616634 973 986 9231

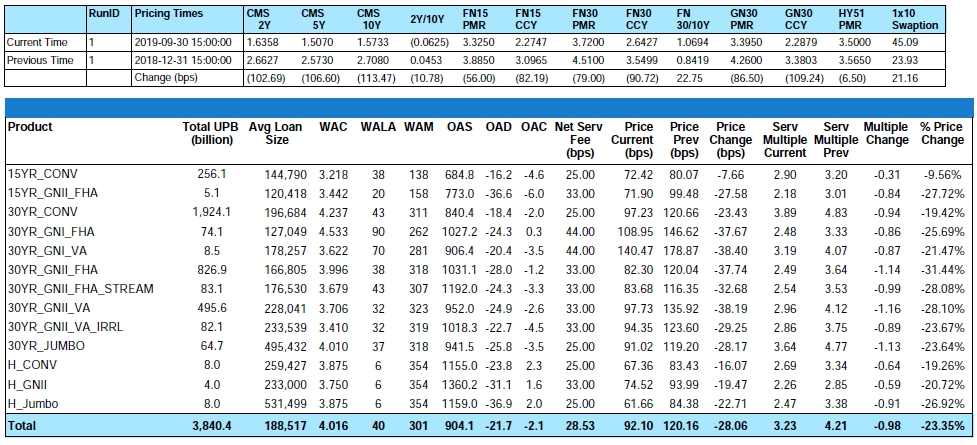

Residential Msr Market Update September 2019 Miac Analytics

1700 Club At Nexa Mortgage Jerome Daniels Mortgage Loan Originator

Your Adjustable Rate Mortgage Needs To Be Refinanced

Why Do We Allow People To Take 30 Years To Pay Off Mortgages When We Sell Them A House Quora

![]()

Team 101 At Northpointe Bank More Mortgage Options Better Pricing Period

Melissa Flom Senior Mortgage Loan Officer Nmls 218418 Mortgage Capital Advisors Linkedin

Exploring The History Of Reverse Mortgages Reversemortgagevalue Com

Jerome Daniels Mortgage Loan Officer 1616634 973 986 9231

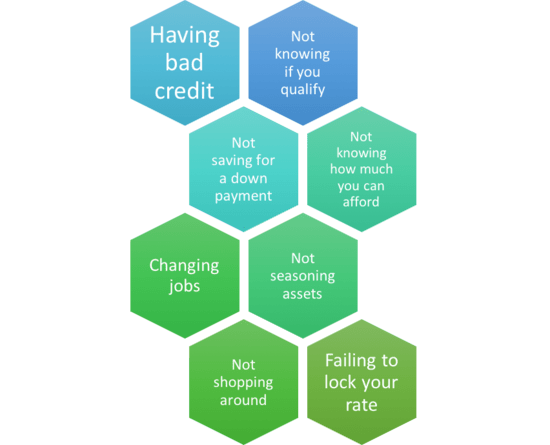

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

Scripts To 30 Loan Documents For Loan Signing Agents Etsy Loan Signing Agent Loan Signing Notary Signing Agent

Lendus Mortgage Rates 5 67 Review Details Origination Data

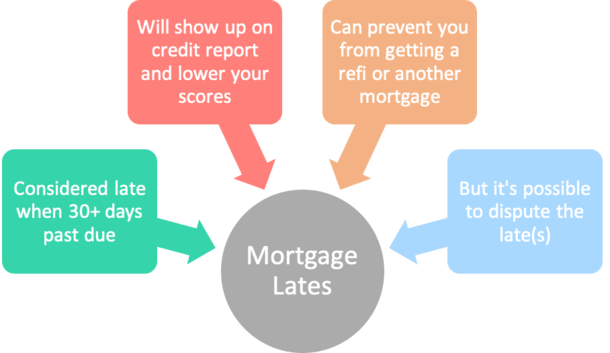

How To Quickly Remove Mortgage Lates From Your Credit Report

Benjamin Cranow Senior Mortgage Advisor Loanguys Com Linkedin

Fidelity Bancorp Funding Home Facebook

2